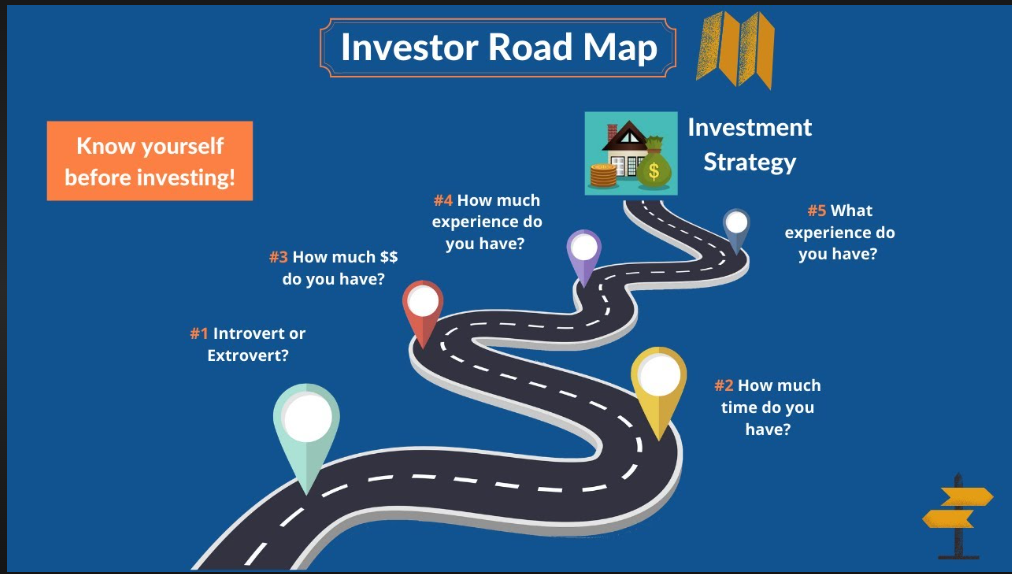

Investing in real estate is a powerful wealth-building strategy that has stood the test of time. While it may seem daunting for beginners, a well-thought-out roadmap can pave the way for success and real estate investment can be easier with the guidance of experienced real estate agent.. In this comprehensive guide, we’ll explore the key steps and strategies for those embarking on their journey into real estate investment.

1. Educate Yourself:

The first step on your roadmap to real estate success is education. Take the time to understand the basics of real estate investing, including terminology, market dynamics, and different investment strategies. Numerous resources, such as books, online courses, and real estate investment forums, can provide valuable insights and knowledge.

Consider attending local real estate investment seminars or networking events to connect with experienced investors and gain practical advice. Developing a solid foundation of knowledge will empower you to make informed decisions as you navigate the complex world of real estate.

2. Define Your Investment Goals:

Clearly define your investment goals before diving into the market. Are you looking for long-term appreciation, rental income, or a combination of both? Understanding your objectives will guide your investment strategy and help you make decisions aligned with your financial goals.

Consider factors such as your risk tolerance, desired level of involvement, and time horizon. Whether you aim to generate passive income, build equity, or achieve financial freedom, having well-defined goals will shape your investment approach.

3. Create a Realistic Budget:

Establishing a realistic budget is a critical aspect of real estate investment. Determine how much capital you can allocate to your investments, taking into account potential financing options such as mortgages or partnerships. Be mindful of not only the property purchase price but also additional costs like closing fees, property taxes, and maintenance expenses.

Your budget should also consider any renovations or improvements needed to increase the property’s value. By having a clear financial plan, you can avoid overextending yourself and set realistic expectations for your investment returns.

4. Research and Analyze Markets:

Successful real estate investors conduct thorough market research to identify lucrative opportunities. Look for markets with strong growth potential, job opportunities, and positive economic indicators. Analyze current and historical property trends, vacancy rates, and rental demand.

Pay attention to neighborhood dynamics, as specific areas within a city may offer better returns than others. Consider working with local real estate professionals or using online tools to access comprehensive market data that can inform your investment decisions.

5. Choose the Right Investment Strategy:

Real estate offers various investment strategies, each with its own set of risks and rewards. Common approaches include:

- Fix and Flip: Purchase distressed properties, renovate them, and sell for a profit.

- Buy and Hold: Acquire properties with the intention of renting them out for a steady stream of income.

- Real Estate Investment Trusts (REITs): Invest in publicly traded companies that own and manage income-generating real estate.

Selecting the right strategy depends on your goals, risk tolerance, and investment timeline. Diversifying your portfolio with a mix of strategies can also help mitigate risk and optimize returns.

6. Build a Professional Network:

Networking is a powerful tool in the world of real estate investing. Connect with professionals such as real estate agents, mortgage brokers, property managers, and fellow investors. A strong network can provide valuable insights, potential investment opportunities, and access to resources that enhance your investment journey.

7. Conduct Due Diligence:

Thorough due diligence is crucial before finalizing any real estate transaction. Inspect properties carefully, review financial documents, and assess potential risks. Verify property titles, zoning regulations, and any legal or environmental issues that may affect the property’s value.

Engage professionals such as inspectors and real estate agent to provide expert assessments. Taking the time to conduct thorough due diligence will help you make well-informed decisions and mitigate unforeseen challenges.

8. Manage Your Properties Effectively:

If you opt for a buy-and-hold strategy, effective property management is key to success. Ensure your properties are well-maintained, respond promptly to tenant needs, and stay informed about local rental market trends. Consider hiring a professional property manager if you prefer a hands-off approach or have multiple properties.

9. Stay Informed and Adapt:

Real estate markets are dynamic and subject to change. Stay informed about industry trends, economic developments, and legislative changes that may impact your investments. Flexibility and adaptability are crucial qualities for successful real estate investors, allowing you to adjust your strategy based on market conditions.

10. Evaluate and Optimize:

Regularly evaluate the performance of your real estate portfolio. Assess the return on investment (ROI) of each property, review market conditions, and consider refinancing or selling underperforming assets. Continuous evaluation and optimization ensure that your investment strategy aligns with your evolving financial goals.

In conclusion, investing in real estate is a journey that requires careful planning, education, and ongoing diligence. By following this roadmap and taking advice from real estate agent advice you can navigate the complexities of the real estate market with confidence and set yourself on a path to long-term success. Remember, patience and a commitment to continuous learning are essential as you build your real estate investment portfolio.